Expert Team

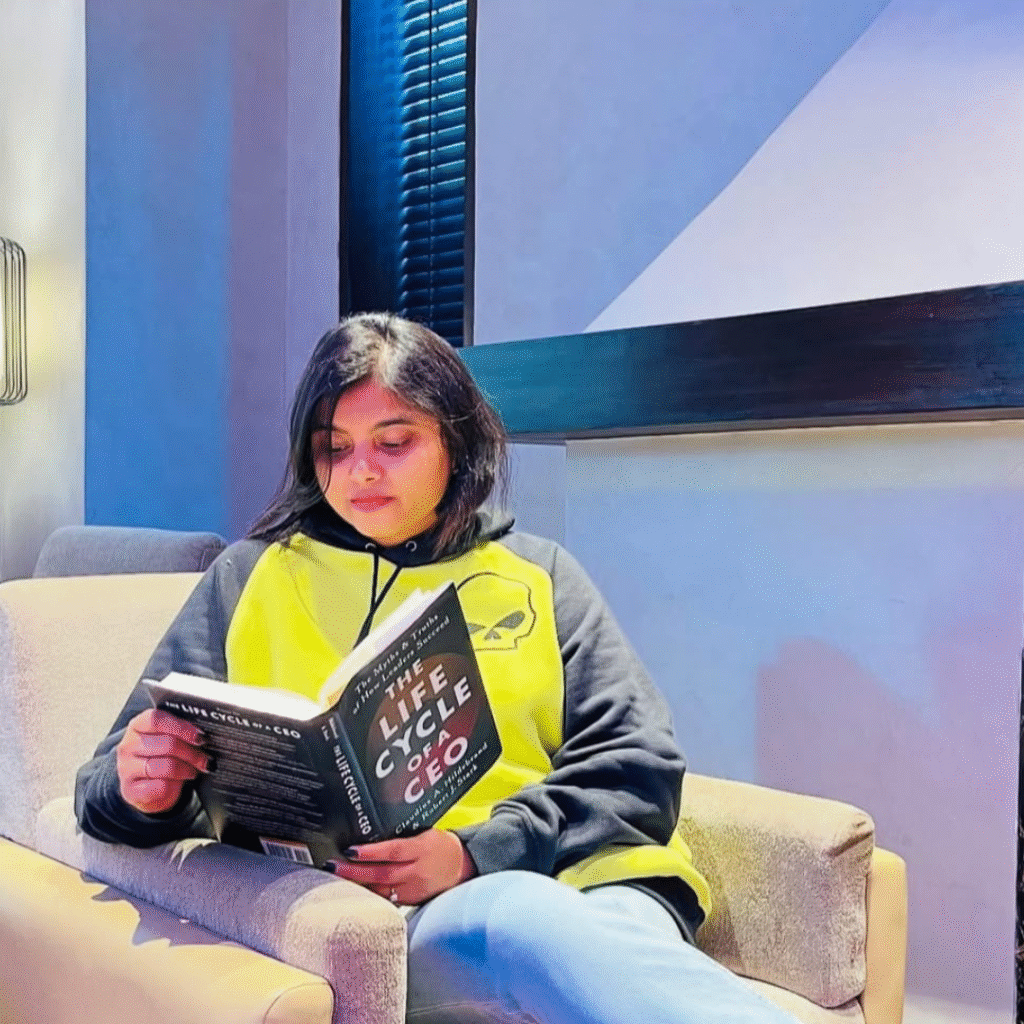

SWATI SRIVASTAVA

CO FOUNDER

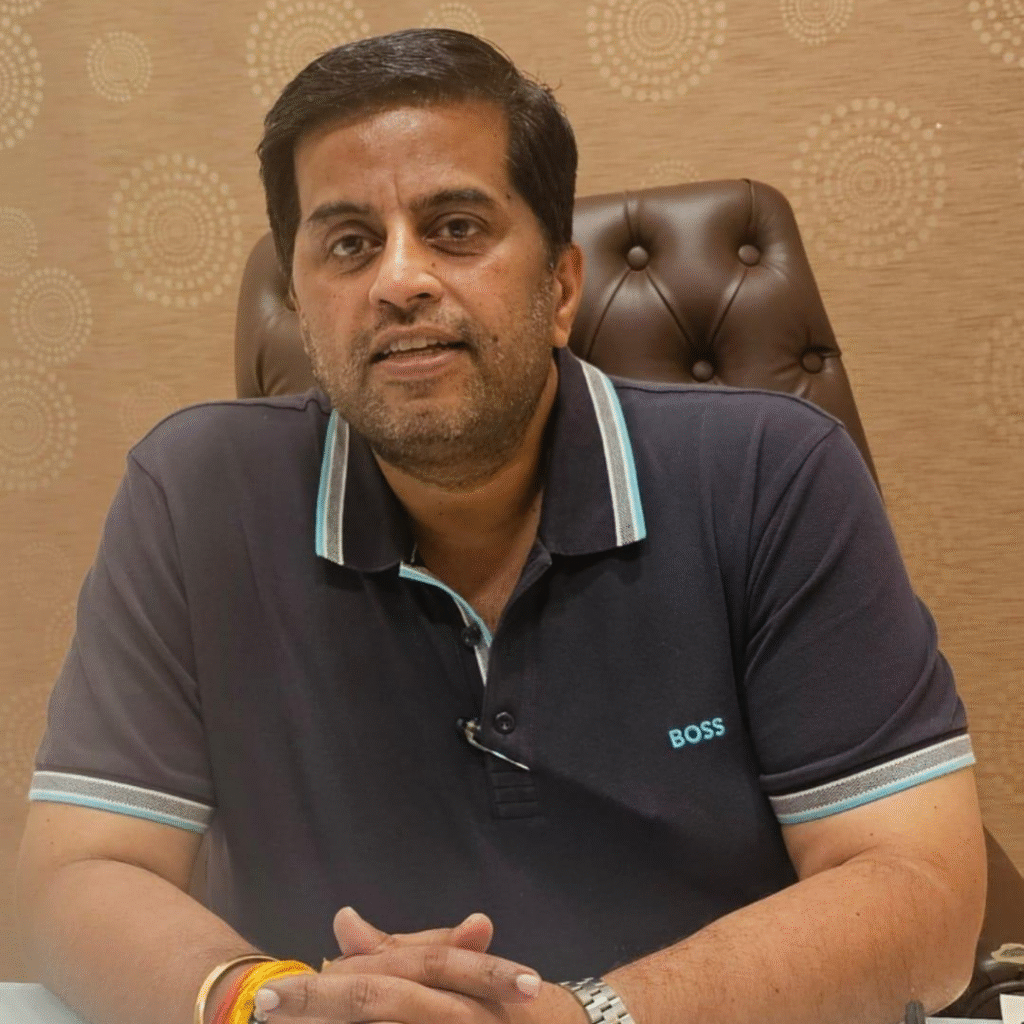

CAPT. RAJ SHETTY

CO FOUNDER

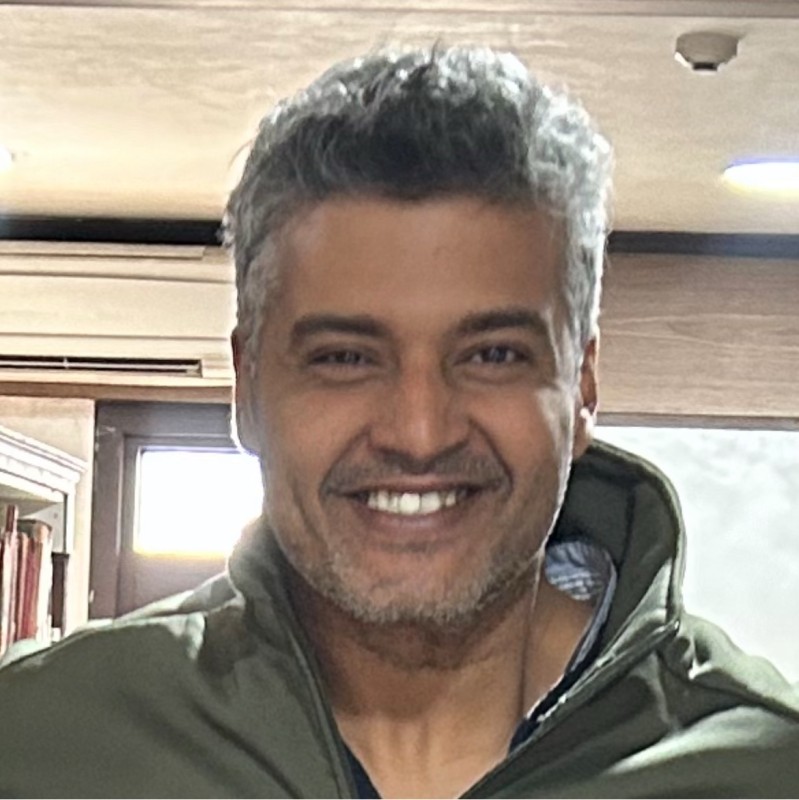

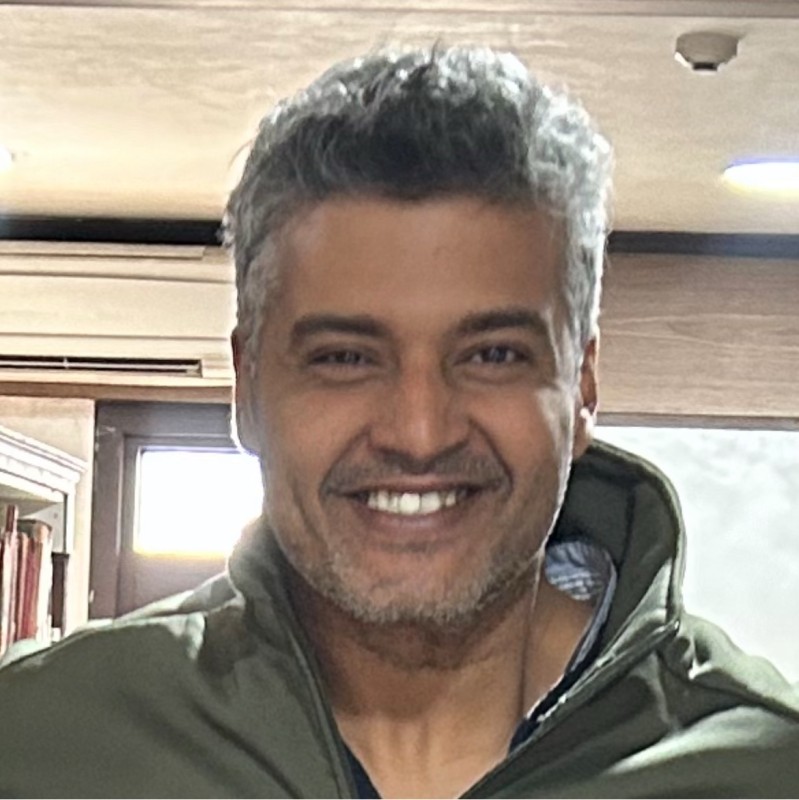

SHYAAM SANTHAKUMAR

Accelerator Head

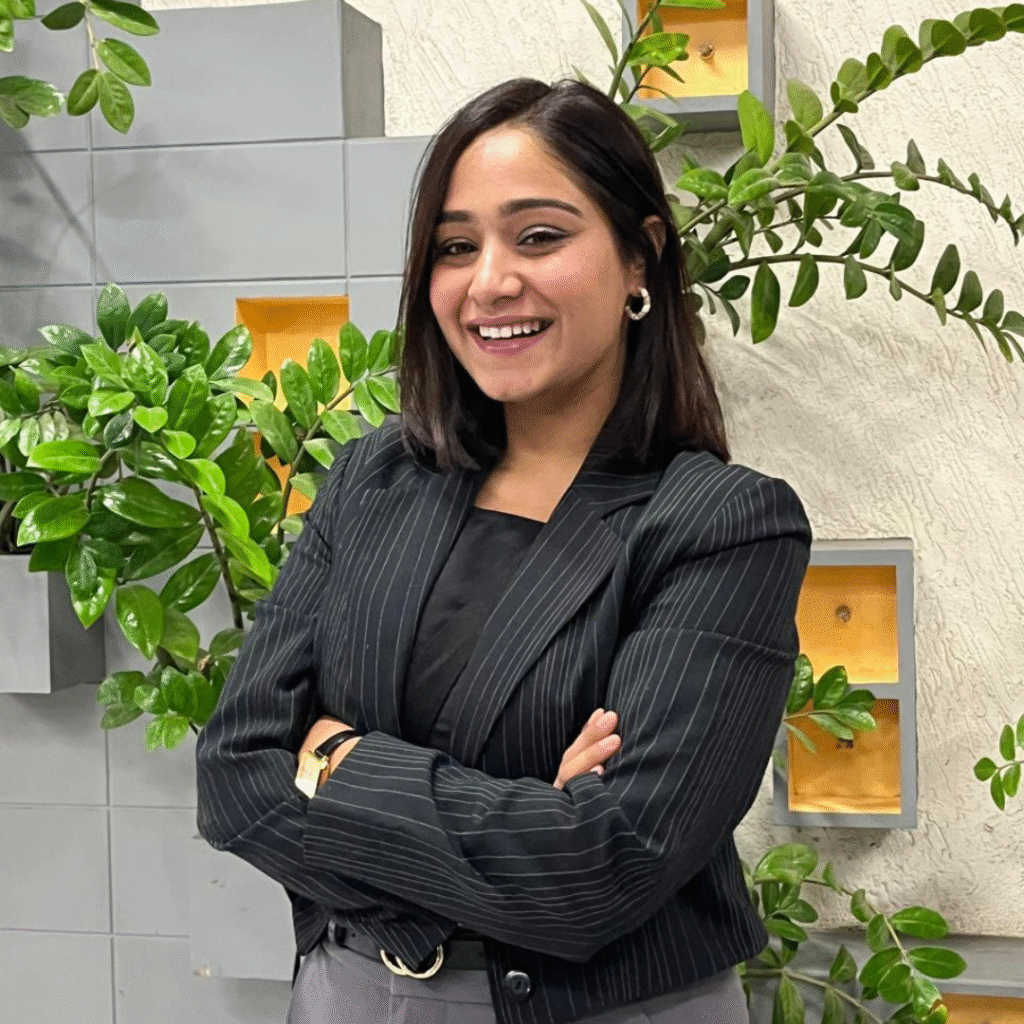

Pooja Ratanani

Legal and Diligence

CS Palash Jain

SWATI SRIVASTAVA

Swati Srivastava builds the people systems that make ventures work. With 15+ years across HR, business design, and organizational transformation, she turns intent into execution—creating performance frameworks, leadership structures, and cultures built for scale.

She works closely with founders and leadership teams to align talent with growth, blending strategy and empathy to create high-trust, high-output organizations. A foster mother and advocate for orphaned girls, Swati aims to empower 100+ children through education and mentorship.

Calm, clear, and people-first, she builds teams that endure and cultures that compound.

CAPT. RAJ SHETTY

Raj Shetty builds ventures that perform under pressure. A former aviation leader with three decades in command and over fifteen years in venture operations, he has led and co-built companies employing more than 41,000 people across India, the Middle East, and Europe.

His focus: systems that scale and execution that endures. Raj has guided multiple early-stage ventures from idea to operating reality, applying aviation-grade precision to business design. At Agastya, he anchors the execution layer—turning complex ideas into disciplined growth engines.

Calm, analytical, and grounded in integrity, Raj makes ventures stable, scalable, and built to last.

SHYAAM SANTHAKUMAR

Shyaam Santhakumar works with early-stage ventures at critical inflection points. With 20+ years across startups, turnarounds, and fundraising, he focuses on making companies investable—refining business models, tightening operations, and preparing founders for capital conversations.

He’s guided ventures through fundraising rounds, restructured distressed assets, and helped scale businesses from concept to commercial traction. His approach is practical: identify what’s broken, fix it quickly, and build toward sustainable growth.

At Agastya, he leads the accelerator—working directly with founders on strategy, investor readiness, and execution discipline. Analytical, grounded, and focused on outcomes, Shyaam helps ventures become fundable and built to scale.

Pooja Ratanani

Pooja Ratanani looks at Legal and Diligence . A practising advocate with experience before the National Company Law Tribunal, she combines litigation expertise with corporate advisory insight.

CS Palash Jain

CS Palash Jain is a capital markets strategist and Practicing Company Secretary known for turning compliance into competitive advantage. As Secretarial Auditor to top-listed manufacturers with operations in India and Thailand, and a trusted supplier to MRF, CEAT, Apollo, and Bridgestone — he has overseen governance and SEBI frameworks for a globally scaled enterprise. Palash brings that same IPO-level discipline to startups, helping them structure smart, stay compliant, and scale towards investor and listing readiness with confidence.

Getting The Best Terms On Your Investment Capital

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Pre-Series A Accelerator Frequently Asked Questions

We're operational turnaround specialists who work hands-on with early-stage companies to make them investment-ready. Think of us as your interim strategic operations team. We get into the weeds of your business—fixing operations, strengthening financials, refining strategy, and building the foundation investors want to see. We run intensive 16-week cohorts where we work directly with each company to transform their operations and prepare them for successful pre-Series A fundraising.

We specialize in six key sectors where we have deep operational expertise:

- Real Estate & PropTech

- Fintech

- Hospitality & Coworking

- Cleaning Services

- Healthcare

- Education

We work with early-stage companies preparing for their pre-Series A fundraising rounds (seed, bridge, or early-stage institutional funding). You may have some initial traction, early customers, or bootstrapped revenue, but you need operational support to become investment-ready and attractive to early-stage investors.

We work with companies through a customized partnership structure. Our engagements typically start at $500,000 and are tailored to your specific operational needs and growth stage. We discuss the exact terms during our diligence process based on the scope of work required to prepare you for Series A.

The real value is our hands-on operational support. We work closely with your team to transform your business into a Series A-ready company. This includes operational restructuring, financial modeling, strategic planning, KPI development, and investor preparation. Our partnerships are structured to align our success with yours.

We're looking for companies that have:

- Strong founding teams with domain expertise

- Early product or service offering with initial market validation

- Early customers, users, or clear demand signals

- Operational challenges that are preventing growth

- Ambition to raise pre-Series A funding (seed, bridge, or early institutional rounds)

- Openness to operational changes and strategic guidance

We typically pass on companies with:

- Fundamental product issues or lack of market demand

- Founder conflicts or cap table problems that can't be resolved

- Industries outside our core sectors (we need domain expertise to add value)

- Companies already investment-ready (you don't need us)

- Teams unwilling to implement operational changes

Send us a brief email with:

- Company overview and what you do

- Current metrics (revenue, users, growth rate)

- What operational challenges you're facing

- Why you're pursuing Series A funding

We'll review and get back to you within one week.

- Deck or one-pager (optional but helpful)

We'll review and get back to you within one week.

Still Have Questions?

Contact us at shyaam@agstyaventures.com, we’re happy to discuss whether we’re the right partner for your journey to Series A.